Websites:

Downloads

What are Medicare Supplement (Medigap) Plans?

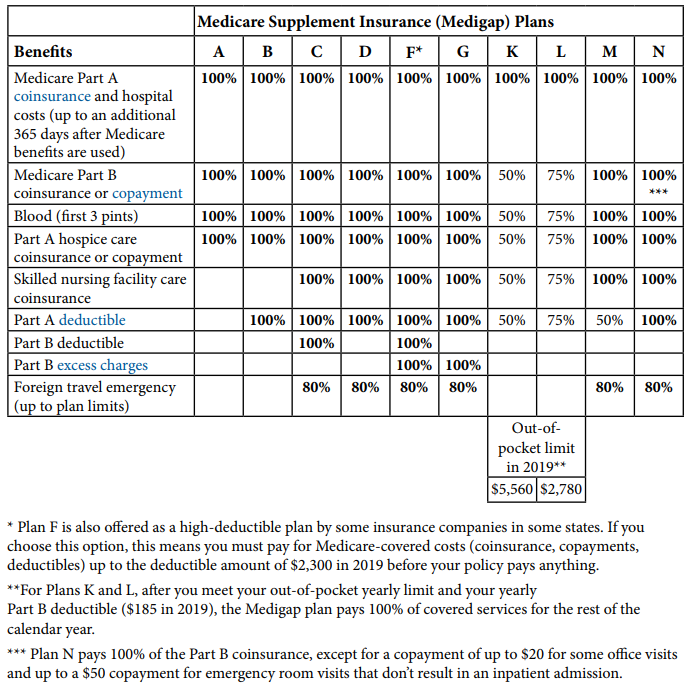

Medicare Supplement insurance is designed to cover a variety of out-of-pocket expenses not covered by Original Medicare coverage. These plans are also known by several names including Medigap, Med Supp, and Medicare Supplemental plans. The type of Medicare Supplement plan determines which deductibles and co-payments are covered by the insurance. In 47 of the United States, there are ten standardized Medicare Supplement plans. These standardized plan types are named with a letter (e.g. A) and all plans of the same letter offer the same benefits. In other words, the benefits for a Medicare Supplement Plan F enrollee in Florida are the same for a Medicare Supplement Plan F enrollee in Texas. Below is a summary of benefits offered by each of the ten standard Medicare Supplement plans:

Important Things to Note about Medicare Supplement Plans

Prices may vary significantly for the same Medicare Supplement plan across different carriers so it is essential that you comparison shop before enrolling. Also, not every insurance company offering Medicare Supplement insurance offers all plan types. An insurer may choose only to offer a subset of plans that Beneficiaries purchase most often, such as Plan F. "Medicare SELECT" refers to a type of Medigap plan that requires beneficiaries to use network hospitals for non-emergencies.

What are Medicare Advantage health plans?

Medicare Advantage plans are private insurance health plans, regulated by the government. Medicare Advantage is also known as "MA" or Medicare Part C. All individuals enrolled in Original Medicare, Part A and Part B, are eligible to enroll in a Medicare Advantage plan, with the exception of those diagnosed with End Stage Renal Disease (ESRD), there are exceptions. MA plans must deliver all benefits and services that Original Medicare covers, such as standardized hospitalization and medical benefits included in Part A and Part B with the exception of hospice care; however, MA plans do not have to deliver these benefits in the same way.

Additional benefits may be included in certain MA plans, which include: Prescription drug coverage; Vision, dental, and/or hearing benefits; Health and wellness programs (Silver Sneakers).

Additional benefits may be included in certain MA plans, which include: Prescription drug coverage; Vision, dental, and/or hearing benefits; Health and wellness programs (Silver Sneakers).

What are options for Medicare Advantage coverage?

Medicare Advantage plans deliver benefits through a number of different options:

- HMO - A health maintenance organization (HMO) is a network of health care providers and facilities, where you choose a primary care physician to coordinate your care.

- HMO POS - A health maintenance organization (HMO) is a network of health care providers and facilities, where you choose a primary care physician to coordinate your care. You can go out of network at a higher cost share for certain services.

- PPO - A preferred provider organization (PPO) is also a network of health care providers and facilities, but typically you do not need to select a primary care physician and have more flexibility regarding out-of-network care.

- PFFS - A private fee-for-service (PFFS) is a mode of benefit delivery where you are not limited to a network, but there are no guarantees that your doctor or hospital will accept the plan.

What is Medicare Prescription Drug Coverage?

Medicare Part D is the government's prescription drug benefit, created by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The Medicare program offers prescription drug coverage to all individuals with Medicare.

A Medicare beneficiary can get prescription drug coverage through one of two options:

A Medicare beneficiary can get prescription drug coverage through one of two options:

- Medicare Part D Prescription Drug Plans, also known as "PDPs", are stand-alone prescription drug plans that are approved by Medicare and offered by a private insurance company. Medicare beneficiaries can sign up for Medicare Part D plans to add drug coverage to their Original Medicare coverage, Medicare Supplement (or Medigap) plan, or certain Medicare Advantage plans, including Cost Plans, Private Fee-for-Service (PFFS) plans, and Medical Saving Account (MSA) plans. Anyone enrolled in either Medicare Part A or Medicare Part B is eligible to enroll in a Medicare Part D plan.

- Medicare Advantage Prescription Drug Plans, also known as "MAPDs", are Medicare Advantage health plans that offer prescription drug coverage. A Medicare beneficiary can access the same Part D drug coverage by signing up for MAPDs that offer both health and drug coverage. To enroll in this type of plan, you need to be enrolled in both Medicare Part A and Part B. In either scenario, a Medicare beneficiary may be required to pay the monthly premium charged by the plan and these premiums vary by insurance provider.

What is the Right Medicare Part D Plan for Me?

The number and variety of Medicare Part D stand-alone drug plans leave consumers with no easy answer to the question "What is the best Medicare Part D drug plan?" Consumers must compare Part D drug plans and, with this drug plan comparison, determine which plan is most affordable and advantageous given their individual drug usage, pharmacy availability, and other factors important to them.

Compare Medicare Part D Plans

Each Medicare Part D drug plan has its own list of covered prescription drugs called a "formulary." Medicare requires all Part D prescription drug plan options to cover at least two or more medications within each therapeutic category (e.g. antidepressant, antibiotic). Medicare specifically excludes Part D plans from covering over-the-counter drugs and medications treating fertility, hair growth, and some other conditions. Since each Medicare Part D plan can cover different drugs, it is essential to evaluate all available Medicare Part D plans in your area to determine: 1. If your drugs are covered. 2. What are the estimated out-of-pocket expenses you should expect to pay during the year for your drugs and plan premiums, and 3. If there are any limitations placed on your drugs (e.g. monthly quantity limits, prior authorization)

Medicare Supplement insurance is designed to cover a variety of out-of-pocket expenses not covered by Original Medicare coverage. These plans are also known by several names including Medigap, Med Supp, and Medicare Supplemental plans.

Medicare Supplement insurance is designed to cover a variety of out-of-pocket expenses not covered by Original Medicare coverage. These plans are also known by several names including Medigap, Med Supp, and Medicare Supplemental plans.

*** MEDICARE PREMIUMS ARE INCOME BASED, AND THOSE WITH HIGHER INCOMES CAN PAY HIGHER PREMIUMS FOR PART B (MEDICAL INSURANCE) AND PART D (PRESCRIPTION DRUG) PLANS ***

This is not a complete listing of plans available in your service area. For a complete listing, please contact

1-800-MEDICARE or consult www.medicare.gov

1-800-MEDICARE or consult www.medicare.gov

We are not associated with Medicare, Medicaid or the Federal government.

© 2015 Executive Resource Insurance Network, Inc. All rights reserved.

6003 Honore Avenue, Suite 104, Sarasota, FL 34238 888.446.4969 Fax 888.470.7871

6003 Honore Avenue, Suite 104, Sarasota, FL 34238 888.446.4969 Fax 888.470.7871